Benefits of MyGreatLakes: Managing student loans can feel overwhelming, but MyGreatLakes is designed to make the process easier. As a federal student loan servicer, it offers a range of features to help borrowers stay on top of their payments, understand repayment options, and even access loan forgiveness programs. Whether you’re a recent graduate or well into repayment, MyGreatLakes provides tools to manage your loans, reduce stress, and stay organized. From automatic payments to loan tracking, it’s an essential resource for simplifying your student loan journey.

Benefits of MyGreatLakes

Managing federal student loans can be a challenging task, but MyGreatLakes offers several benefits that simplify the process. From loan repayment flexibility to valuable resources for managing financial hardship, here’s a breakdown of how MyGreatLakes makes a difference in the lives of borrowers.

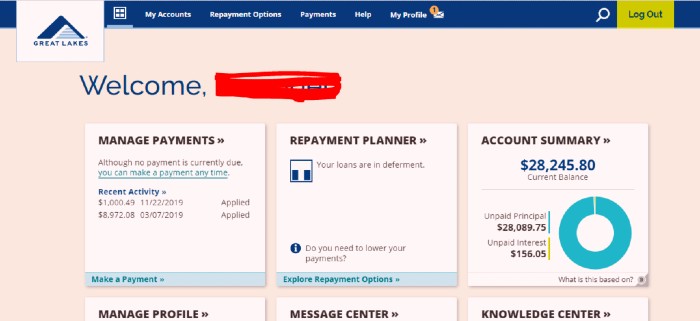

Easy Access to Loan Details

One of the key benefits of MyGreatLakes is the straightforward access it provides to your loan information. By logging into your account, you can easily view all your loan details in one place. This includes your current loan balance, interest rates, payment history, and upcoming due dates. Having all this information readily available ensures that borrowers can make informed decisions and stay on top of their payments.

Flexible Repayment Plans

MyGreatLakes offers a variety of repayment plans that borrowers can choose from, depending on their financial circumstances. This flexibility is essential in ensuring that payments remain manageable throughout the life of the loan. Options like income-driven repayment plans, extended repayment, and standard repayment plans allow borrowers to select the best option for their unique financial situation. Adjustments can be made at any time, making it easier to respond to changes in income or financial hardship.

Loan Forgiveness Program Guidance

For borrowers working in certain public service fields, MyGreatLakes helps guide them through the process of qualifying for federal student loan forgiveness programs. These programs can significantly reduce or even eliminate a borrower’s remaining balance after a set number of years of qualifying payments. MyGreatLakes provides detailed information about eligibility, application steps, and how to track progress toward forgiveness, helping borrowers understand how they can take advantage of these valuable opportunities.

Automatic Payment Setup

Setting up automatic payments through MyGreatLakes is another major benefit. With autopay, your payments are automatically deducted from your bank account each month, helping ensure that you never miss a payment. This is a great way to stay organized and avoid late fees or penalties. Plus, borrowers who enroll in autopay often receive a small interest rate reduction, making it an even more cost-effective option.

Deferment and Forbearance Options

Life can be unpredictable, and sometimes financial hardship makes it difficult to keep up with loan payments. MyGreatLakes offers options for deferment and forbearance, which allow borrowers to temporarily pause their loan payments in situations like job loss, health issues, or other financial struggles. This can help prevent loans from falling into default while providing the borrower with some time to recover financially.

Resources for Financial Literacy

MyGreatLakes goes beyond just managing loans by providing valuable educational resources. These tools help borrowers better understand their financial situation, explore budgeting tips, and make well-informed decisions about managing their student loans. With financial literacy resources available, borrowers can improve their overall financial wellness and reduce stress related to their loan payments.

Simplified Communication with Loan Servicers

MyGreatLakes serves as a centralized hub for communication with loan servicers. If you have any questions or need assistance, you can easily contact customer support through the platform. Whether you’re looking for clarification on a loan feature or need help adjusting your repayment plan, MyGreatLakes offers streamlined communication options to make the process as efficient as possible.

Payment History and Progress Tracking

Tracking your progress toward paying off your loan is crucial to staying motivated. MyGreatLakes provides a clear view of your payment history, so you can monitor how much you’ve paid and how much is left. This feature helps you understand how quickly you’re moving toward paying off your loan, allowing you to adjust your payment strategy if needed.

Tax Benefits

For those making loan payments under certain conditions, MyGreatLakes can provide information on tax benefits. Specifically, borrowers may be eligible for tax deductions on student loan interest. MyGreatLakes can assist with generating a 1098-E form, which details how much interest you’ve paid on your loans, making it easier to claim these deductions when filing your taxes.

Seamless Account Management

Managing your loans through MyGreatLakes is a smooth and intuitive experience. The online platform is designed to be user-friendly, with clear options for making payments, changing payment plans, and applying for deferment. With a clean interface and easy navigation, borrowers can manage their loans efficiently and with confidence.

FAQs

What is MyGreatLakes?

MyGreatLakes is a federal student loan servicer that helps borrowers manage their student loans. It provides tools for loan repayment, tracking loan balances, exploring repayment plans, and more.

How do I access MyGreatLakes?

You can access MyGreatLakes by visiting their website and logging into your account using your username and password. If you don’t have an account, you can create one by following the prompts on their site.

What repayment options does MyGreatLakes offer?

MyGreatLakes provides various repayment plans including income-driven plans, extended repayment, and standard repayment options, allowing you to choose the plan that best fits your financial situation.

Can I apply for deferment or forbearance through MyGreatLakes?

Yes, MyGreatLakes allows you to apply for deferment or forbearance if you experience financial hardship, giving you temporary relief from payments.

How can MyGreatLakes help with loan forgiveness?

MyGreatLakes provides guidance on loan forgiveness programs, particularly for those in public service jobs. It offers resources to help you track your progress toward forgiveness.

Conclusion

MyGreatLakes simplifies the complex world of student loan management. With its array of tools and features, borrowers can track their loans, manage payments, and access repayment options or forgiveness programs. By offering flexibility, ease of use, and security, MyGreatLakes helps borrowers stay on top of their financial responsibilities, making the student loan journey more manageable and less stressful.

Whether you’re just starting to repay your loans or you’re nearing the end, MyGreatLakes is an invaluable resource for making the process easier and more organized.